-

Články

- Vzdělávání

- Časopisy

Top články

Nové číslo

- Témata

- Kongresy

- Videa

- Podcasty

Nové podcasty

Reklama- Kariéra

Doporučené pozice

Reklama- Praxe

Modelled health benefits of a sugar-sweetened beverage tax across different socioeconomic groups in Australia: A cost-effectiveness and equity analysis

Anita Lal and colleagues model for and reveal the potential health benefits and cost savings from a sugar sweetened beverage tax in Australia.

Published in the journal: . PLoS Med 14(6): e32767. doi:10.1371/journal.pmed.1002326

Category: Research Article

doi: https://doi.org/10.1371/journal.pmed.1002326Summary

Anita Lal and colleagues model for and reveal the potential health benefits and cost savings from a sugar sweetened beverage tax in Australia.

Introduction

In high-income countries, obesity is more common in the most disadvantaged groups [1]. Reducing inequalities in health between advantaged and disadvantaged groups is an important objective of public health policy [2]. The evidence of the association between sugar-sweetened beverage (SSB) intake and increased energy intake, leading to weight gain and obesity, is compelling [3,4]. Obesity is a strong risk factor for diabetes, cardiovascular disease, some cancers, osteoarthritis, and hypertension [5–7]. Individuals from lower socioeconomic groups have been found to consume more SSBs [8,9]. The prevalence of obesity-related comorbidities is also higher in lower socioeconomic groups.

A tax on SSBs is considered to be an important component of the set of recommended policy approaches to address population obesity [10–12]. Price influences SSB purchase [13], which in turn may reduce the rate of obesity [14]. There is an economic rationale for taxes when consumption results in negative externalities. In Australia, the diseases caused by obesity were estimated to cost tax payers AU$5.3 billion in healthcare costs, forgone tax, and welfare payments in 2014/2015 [15]. The economic rationale for an SSB tax essentially rests on the notion of ‘internalising the externality’ within the purchase price.

There is evidence that people with lower incomes are more sensitive to price increases [16] and are therefore more likely to change their purchasing behaviour in response to price changes. In Mexico, an evaluation of an SSB tax of approximately 10% introduced in 2014 showed a reduction in purchases of taxed beverages for the total population, with an even larger effect for lower-income households [17,18].

The financial impact of an SSB tax for different socioeconomic position (SEP) groups has been examined in terms of the predicted tax burden to individuals and households. A recent systematic review describing the financial burden of an SSB tax across different SEP groups identified 5 studies, which found that the tax would be financially regressive, but with small differences of approximately US$5 between high - and low-income households; the average additional tax paid per household as a result of the SSB tax would be less than US$30 annually across all groups [19]. Previous Australian research has predicted that an SSB tax would lead to cost savings in the health sector [20,21]. But the effect on overall healthcare cost savings and the health gains in health-adjusted life years (HALYs) across SEP groups have rarely been previously examined. The overall financial impact on individuals includes the potential healthcare costs saved by individuals, and this also has seldom been previously estimated across SEP groups. A rate of 20% is the most commonly advocated tax by public health experts [22]. South Africa and the UK have recently proposed taxes of this magnitude [23]. The main aim of this paper, therefore, is to examine the health and financial impacts of a 20% SSB sales tax for Australia across socioeconomic groups by comprehensively integrating distributional aspects into the cost-effectiveness analysis.

This study expands on previous studies in a number of ways. First, the cost-effectiveness of a 20% SSB tax for Australia by SEP subgroup was estimated, including a wide range of SSBs and substitute beverages, with a focus on the quantity and distribution of health gains in HALYs according to an area-based measure of socioeconomic disadvantage, Socio-Economic Indexes for Areas (SEIFA). Second, the distribution of financial impacts to individuals across different SEP groups was examined, in terms of out-of-pocket costs incurred from the tax and healthcare costs saved. Third, the overall economic impact of the tax was examined in terms of the balance of effects for the health sector and the general economy.

Methods

Specification of the tax

A 20% sales tax on SSBs in Australia was modelled. SSBs included soft drinks (pop, soda); flavoured water; sports, energy, and fruit drinks; and cordials (concentrates) containing added sugar. It was assumed that the full amount of the tax would be passed on to the consumer.

Overview

The model estimated the differences in life expectancy and HALYs pre - and post - implementation of the tax. These differences were based on predicted variations in 9 diseases caused by obesity. Changes to body mass index (BMI) were modelled based on projected changes in SSB consumption.

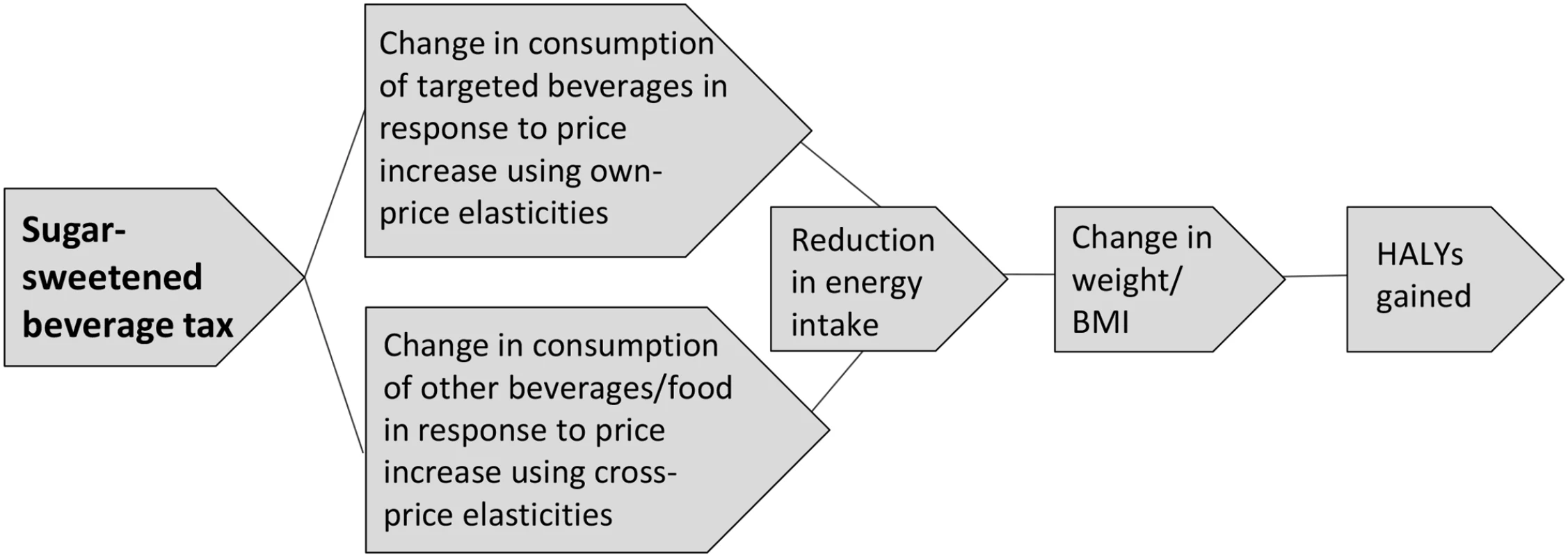

The Australian population aged 2–100 years was modelled over a lifetime, with covariates based on the Australian Health Survey (AHS) 2011–12 [24] and disease epidemiology based on a study of the US burden of diseases, injuries, and risk factors in 2010 [25]. The analysis has 2 parts: (1) a whole population analysis and (2) analyses by SEIFA quintile. Fig 1 illustrates the logic pathway of an SSB tax, identifying the steps involved in measuring the expected impact of the tax from an obesity perspective.

Fig. 1. Logic pathway for modelling the health effects of a sugar-sweetened beverage tax.

BMI, body mass index; HALY, health-adjusted life year. Assessment of benefit

Effect of the tax on body weight

For the whole population analysis, baseline intake of drinks was based on data from the AHS 2011–12 [24]. Dietary data were collected based on 24-hour dietary recall on 2 separate days. Mean daily intake of each category of SSB and substitutes of tea, coffee, milk, and 100% fruit juice were extracted from the survey using Stata 14 [26]. Mean intake was calculated by sex, in 5-year age groups.

For the SEP subgroup analyses, individuals in the survey were categorised by SEIFA Index of Relative Socio-Economic Disadvantage (IRSD) deciles, which were converted to quintiles. The SEIFA quintiles represent groups of individuals who live in similarly ranked areas, based on a range of information such as the income, qualifications, and occupation skills of the area residents [27]. Mean SSB intake for the quintiles was not extracted by age group as the groups were too small. However, an age multiplier was applied based on proportions of intake by age from the total population (see S1 Table for mean intake).

The change in intake of SSBs associated with a 20% tax was based on an Australian study that derived own-price elasticities and cross-price elasticities from Australian household supermarket purchases and a mathematical demand system model [28]. Own-price elasticities represent the proportional change in SSB purchases in response to a change in SSB price. Cross-price elasticities represent the proportional change in purchases of other substitute drinks (such as coffee) in response to a change in SSB price. We applied the price elasticities derived for the low - and high-income households, respectively, to the consumption of SSBs in the lowest and highest SEIFA quintile [28]. The price elasticities for the middle-income households were applied to SEIFA quintile 3. The price elasticities for quintiles 2 and 4 were interpolated using linear trends estimation from quintiles 1, 3, and 5 in Excel (see S2 Table). The reductions in quantities of SSBs consumed and increases in substitute drinks consumed were converted to kilojoule equivalents using nutrient tables for Australia (NUTTAB, 2010) [29].

Estimated changes in body weight for adults were calculated based on published relationships between changes in energy expenditure and body weight at the population level. Changes in body weight for adults were based on a change of 100 kilojoules per day equalling a 1-kg change in weight, taking 3 years to achieve the total weight change [30]. The following formulas were used for children [31]:

These changes in weight were converted to changes in BMI using average Australian height and weight by gender and single-year age groups up to 19 years and 5-year age groups thereafter from the AHS 2011–12 [24].Modelling health outcomes

We used a recently developed model (CRE-Obesity model) to estimate how a change in the distribution of the prevalence of overweight and obesity caused by an intervention impacts the epidemiology of several obesity-related diseases, which in turn influence the total HALYs in the population. This model was based on the Assessing Cost-Effectiveness in Prevention (ACE-Prevention) obesity model [32,33], which has previously been used to model the cost-effectiveness of several obesity interventions [34–36]. We extended the model by considering the incremental costs and benefits by SEIFA quintile, as well as by including children and adolescents.

The model uses a multi-state, multiple cohort life table approach to translate changes in mean BMI following an intervention into corresponding HALYs gained. Potential impact fractions were used to quantify the proportional reduction in disease incidence that would occur if a population were subject to a counterfactual exposure to a risk factor because of an intervention [37]. Disease-specific mortality and morbidity were then combined with all other causes of mortality and morbidity from the population to estimate the total morbidity and mortality in the total population. The diseases were diabetes mellitus, ischemic heart disease, stroke, hypertensive heart disease, colorectal cancer, breast cancer, endometrial cancer, kidney cancer, and osteoarthritis of the knee and hip.

The CRE-Obesity model calculates incremental HALYs, incremental costs, and cost-effectiveness ratios. Using the SEIFA IRSD, we created quintile-specific sub-models by substituting key input parameters with SEIFA-quintile-specific data. These parameters included disease incidence [38–40], mortality rate [41], BMI distribution [42], and population number [43]. We modelled the SSB tax on SEIFA groups as a population-based intervention—that is, the lifetime health and cost effects from the tax altered the distribution of BMI among all ages (2–100 years). For individuals aged 2–19 years, who were not modelled as experiencing the included diseases, the disability related to obesity itself was quantified, using the health-related quality of life lost due to obesity before and after the intervention, based on the difference between quality-adjusted life year (QALY) weights [44]. Thus, HALYs gained due to an intervention represent the number of years lived in full health gained, adjusted for morbidity of obesity-related diseases, and obesity as a whole in the population aged less than 20 years.

Assessment of costs

Intervention costs

Intervention costs were assessed from both a government and industry perspective over the lifetime of the population. In the absence of Australian data on the administration and compliance costs of implementing a soft drink tax, costing methods from a US study of 2 states operating an excise tax were converted to the equivalent Australian costs [45]. Estimates of legislation costs of tobacco plain packaging in terms of establishment, implementation, ongoing compliance, and administration costs for the Australian Department of Health, at AU$12.69 million (m) over 10 years, were used as a benchmark [46]. Administration costs to the beverage industry were assumed to be equal to the costs to government, based on sales tax evidence in the US [47].

A framework for costing new public health legislation was used to estimate the cost of passing legislation in the Australian parliament [47], with slight adjustments for the Australian context. Briefly, it includes parliamentarians’ time, annual expenses for the House of Representatives and the Senate, legislation drafting, and publication and policy advice. As we could not identify costs for policy advice in Australia, we used the equivalent Australian dollar costs from New Zealand (NZ) (see S3 Table).

Healthcare costs

Treatment costs were based on Disease Costs and Impact Study (DCIS) 2001 data from the Australian Institute of Health and Welfare (AIHW) [48], inflated to 2010 prices using AIHW health price inflation values [49]. Costs included hospital services, out-of-hospital medical services, pharmaceuticals, and health professionals. Healthcare expenditures saved were estimated based on the predicted reduction in mortality and morbidity from the 9 diseases.

Out-of-pocket healthcare costs

Out-of-pocket healthcare costs are healthcare costs paid for by individuals and include pharmaceuticals, medical services, practitioners, aids and appliances, and hospital costs. Out-of-pocket healthcare costs by SEIFA quintile were based on the percentage of individuals’ overall expenditure used for total healthcare expenditure, reported by the AIHW in 2010 as 17.4% [49]. Proportions of mean household annual healthcare expenditure and total household expenditure, together with ‘equivalised’ disposable income by quintile from the Australian Bureau of Statistics Household Expenditure Survey 2010 [50], were used to calculate quintile-specific out-of-pocket healthcare costs as a percentage of overall expenditure. Equivalisation is a technique in economics whereby members of a household receive different weightings. Total household income is then divided by the sum of the weightings to yield a representative income.

Deadweight loss (loss in economic welfare)

Deadweight loss (DWL) is an economic term used to describe the net loss in total economic welfare that can be attributed to the introduction of a new tax or tax increase. The tax drives a price increase that leads to a fall in demand; this in turn involves reduced benefits flowing to both consumers and producers. As a result, there is a reduction in both consumer surplus (the difference between the value a consumer places on a product and the price paid) and producer surplus (the price minus the economic cost of producing the product) (refer to S1 Fig for additional detail). This loss in economic welfare is calculated for each SSB category for each quintile and for the population using the following formula:

where P1 is the original price of the SSBs, P2 is the new price of the SSBs, Q1 is the original quantity demanded of the SSBs, and Q2 is the new quantity demanded of the SSBs.The total loss of economic welfare is thus the amount of DWL in excess of the taxation revenue collected by the government. There are also behavioural responses associated with these inherently dynamic impacts that are not fully captured in this formula—desirably, industry realigns to healthier products, consumers realign to healthier purchases, and the tax revenue can be utilised for welfare-enhancing initiatives.

Out-of-pocket tax costs

Predicted tax paid per person due to the introduction of a 20% SSB tax was calculated as the post-tax mean quantity demanded of each category of SSB consumed multiplied by 20% of the current retail price. This assumes that the full burden of the tax is borne by the consumer. We used prices sourced from a large Australian supermarket website (Coles; http://www.colesonline.com.au). An average price per litre was taken from a range of sizes and brands. Mean annual expenditure on food and non-alcoholic drinks by ‘equivalised’ disposable income quintile from the Australian Household Expenditure Survey 2010 [50] was used to calculate percentage of annual expenditure on food and non-alcoholic drinks.

Tax revenue

The tax revenue predicted to be received by the government was calculated by multiplying the per person out-of-pocket tax cost by the number of people in each population group.

Cost-effectiveness analysis

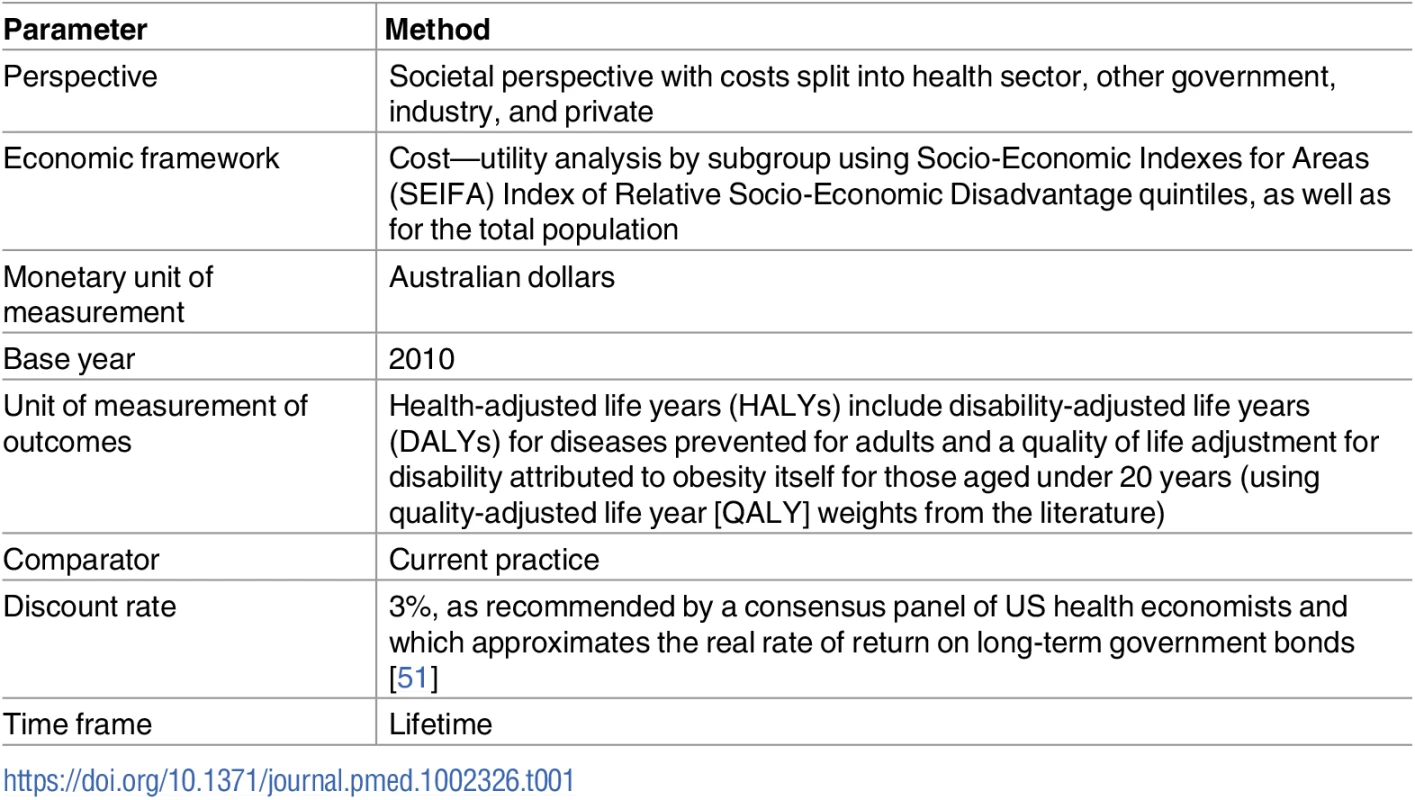

Table 1 outlines the general methodology of the economic evaluation. The intervention was assumed to be operating in ‘steady state’ (i.e., running at its full effectiveness potential) and was measured against current practice. Establishment costs were included in the cost of the intervention. The additional costs and the associated health benefits (HALYs) resulting from the tax were used to calculate incremental cost-effectiveness ratios (ICERs), defined as the difference in net costs of the tax compared to no tax, divided by the difference in net HALYs.

Tab. 1. General economic evaluation methods.

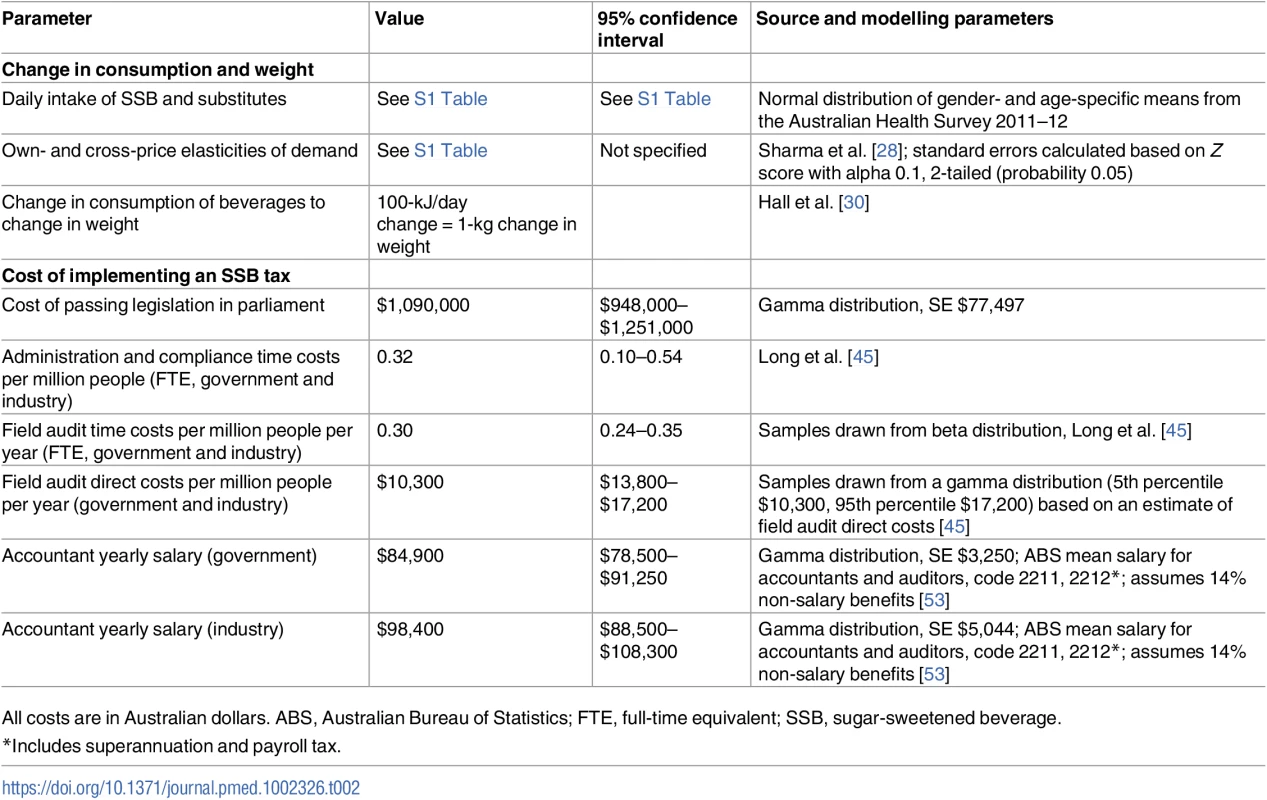

Uncertainty and sensitivity analysis

The impact of uncertainty around input values on the main outcome measures was estimated by Monte Carlo simulations (Table 2). Means and 95% confidence intervals for BMI effects on HALYs and intervention costs were reported based on 2,000 iterations using Ersatz version 1.3 software [52].

Tab. 2. Key model parameters.

All costs are in Australian dollars. ABS, Australian Bureau of Statistics; FTE, full-time equivalent; SSB, sugar-sweetened beverage. We performed several sensitivity analyses. We performed one-way sensitivity analyses to explore the effect of including flavoured milk in the SSBs. As the price elasticity for flavoured milk was not available, we assumed the same price elasticity as for soft drinks. We also tested an SSB tax rate of 30% and a 50% pass-through of the 20% tax. Another mechanism for implementing a tax—a 50¢ per litre volumetric tax was also tested. This is in line with alcoholic beverages in Australia, which are taxed per litre of alcohol. A tax of 50¢ per litre is an average 17% increase in price across all SSB categories.

Health equity analysis

A concentration index quantifies the degree of socioeconomic inequality in a specific health variable. Concentration indices were calculated for each tax scenario (sensitivity analysis) to quantify the degree to which HALYs gained are concentrated in disadvantaged groups. The index takes a negative value when HALY gains are greater amongst the most disadvantaged, and a positive value when HALY gains are greater amongst the least disadvantaged. The concentration index was calculated for each tax scenario using the following formula [54]:

where ut is the mean number of HALYs of the tth SEIFA group, ft is its population share, and Rt is the fractional rank of SEIFA group t.Results

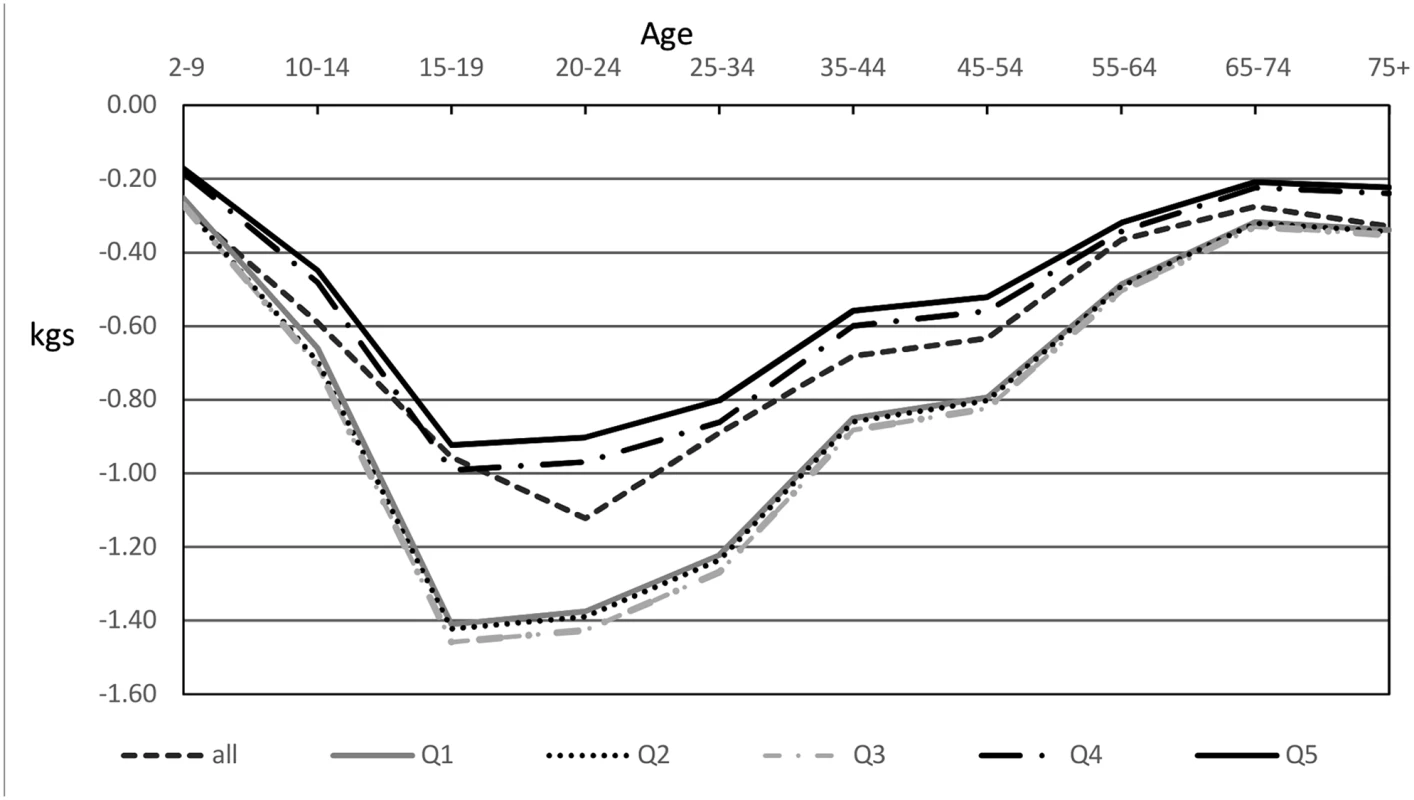

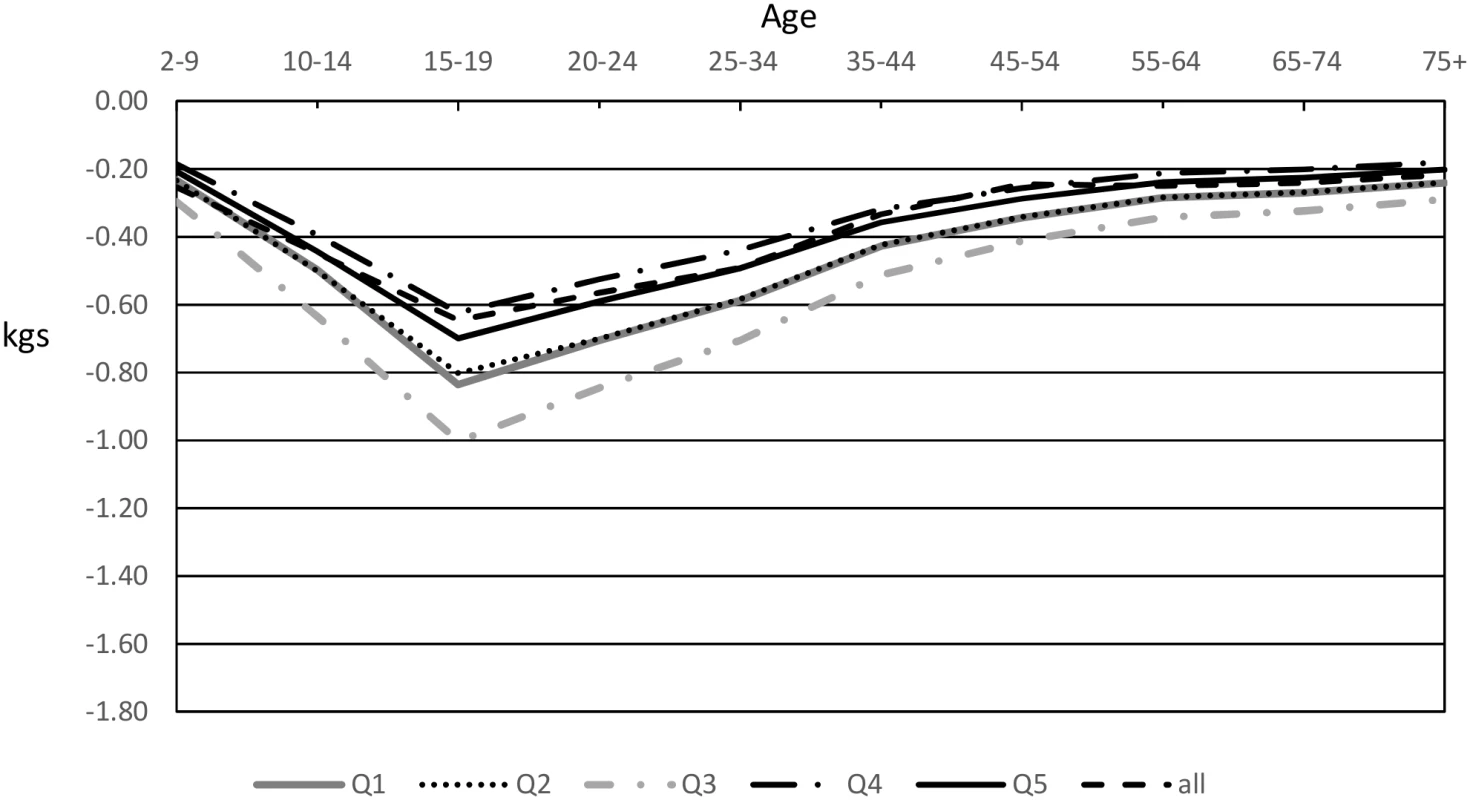

Enacting a 20% SSB sales tax in Australia was estimated to result in greater decreases in weight for the 3 most disadvantaged quintiles than for the 2 least disadvantaged quintiles for both men and women, with larger decreases in men. Quintile 5 (least disadvantaged) had the lowest predicted reductions in weight for men and women (Figs 2 and 3).

Fig. 2. Modelled mean weight decreases in men after introduction of a 20% sugar-sweetened beverage tax by quintile.

Q1 is the most disadvantaged quartile, and Q5 is the least disadvantaged quartile. Fig. 3. Modelled mean weight decreases in women after introduction of a 20% sugar-sweetened beverage tax by quintile.

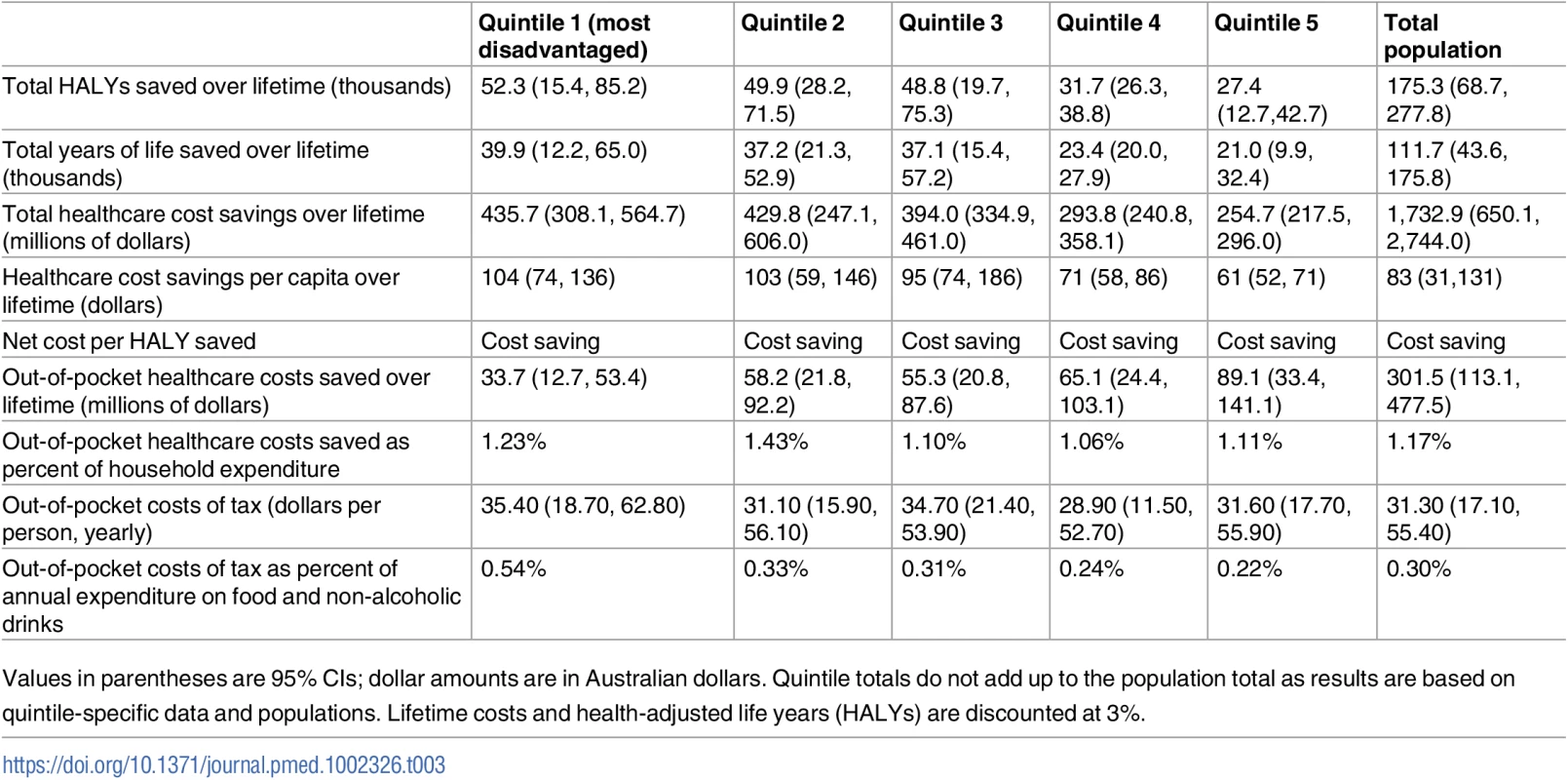

Q1 is the most disadvantaged quartile, and Q5 is the least disadvantaged quartile. As a result of a 20% SSB tax, the Australian population was estimated to gain 175,300 HALYs (95% CI: 68,700; 277,800) and save 111,700 years of life (95% CI: 43,600; 175,800) (Table 3). The HALY gains were highest in the 2 most disadvantaged quintiles, with 49.4% of the total HALYs gained accruing to these quintiles. Quintile 5 had the lowest HALYs gained and years of life saved for men and women.

Tab. 3. Cost-effectiveness results of a 20% sugar-sweetened beverage tax.

Values in parentheses are 95% CIs; dollar amounts are in Australian dollars. Quintile totals do not add up to the population total as results are based on quintile-specific data and populations. Lifetime costs and health-adjusted life years (HALYs) are discounted at 3%. The tax was estimated to be cost saving across all intervention scenarios (sensitivity analyses) and all quintiles. Over the lifetime of the population cohort, expected healthcare cost savings were AU$1.73 billion, intervention costs were estimated to be AU$119.6m (95% CI: $91.9m; $162.1m)—approximately $4.8m (95% CI: $3.9m; $6.1m) in the first year and $3.7m (95% CI: $2.8m; $5.0m) in subsequent years, discounted at 3%. For every dollar invested in the first 10 years, the tax would result in AU$17 (95% CI: $9; $19) in healthcare cost savings. The tax revenue generated at the population level was estimated to be AU$642.9m annually (95% CI: $348.2m; $1,117.2m).

For the total population, the out-of-pocket healthcare costs saved were estimated to be AU$299.4m (95% CI: $113.8m; $476.2m). Healthcare cost savings as a percentage of household expenditure by quintile were highest in the most disadvantaged groups. Per capita, the most disadvantaged quintile was estimated to incur the most tax, at an estimated AU$35.40 (95% CI: $18.70; $62.80) per year, or 0.54% of expenditure on food and non-alcoholic drinks.

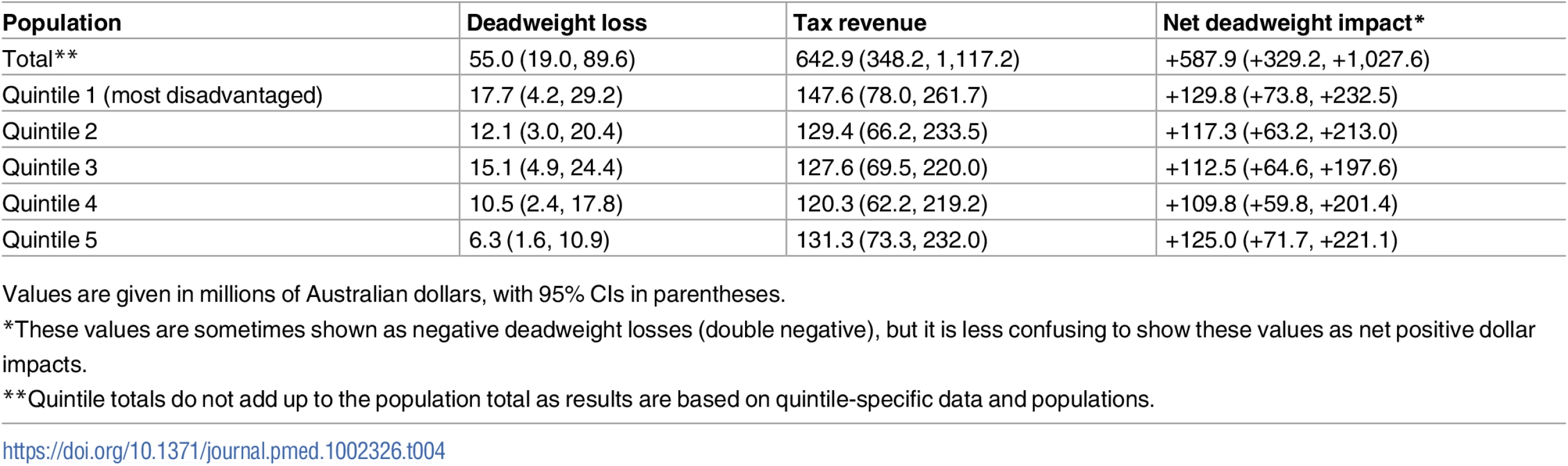

The tax revenue raised outweighed the DWL for the total Australian population, with an estimated net deadweight impact of +AU$587.9m (95% CI: +$329.2m, +$1,027.6m) per year. The DWL was more than offset by tax revenue across all quintiles, with substantial net gains in each quintile (Table 4).

Tab. 4. Estimated net deadweight impact of a 20% tax on sugar-sweetened beverages.

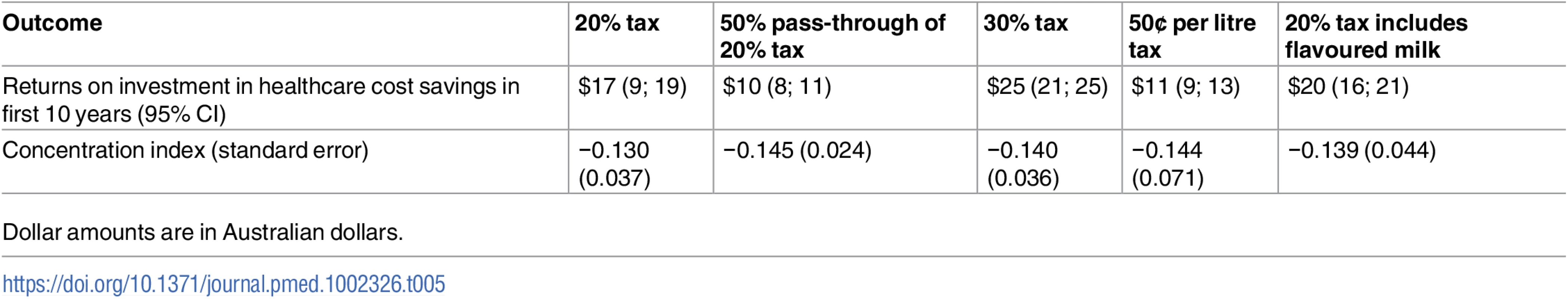

Values are given in millions of Australian dollars, with 95% CIs in parentheses. Sensitivity analyses

The SSB tax remained cost saving when (1) the pass-through rate was 50%, (2) the rate of the tax was 30%, (3) flavoured milk was included as an SSB, and (4) a volumetric tax was applied at 50¢ per litre (see S4 Table). For each dollar invested in the first 10 years, the resulting healthcare cost savings ranged from $10 to $25 (Table 5).

Tab. 5. Returns on investment in healthcare cost savings and concentration indices of tax scenarios.

Dollar amounts are in Australian dollars. All tax scenarios have a negative concentration index, indicating that the highest proportion of HALYs gained is amongst the most disadvantaged quintiles. The 50% pass-through of a 20% tax and the 50¢ per litre tax had the largest negative indices, indicating the most equitable scenarios (Table 5).

The 30% tax rate scenario resulted in the largest difference between the lowest and highest quintiles in terms of out-of-pocket costs for the tax; however, this scenario resulted in the largest health gains and healthcare costs saved across the population. Compared to a 20% tax, a 50¢ volumetric tax resulted in smaller health gains across all SEIFA quintiles, due to the level of tax translating to a lower level of price increase across all drink categories.

Discussion

In our study we estimate that a 20% sales tax on SSBs in Australia would result in the largest number of obesity-related HALYs being averted in the population living in the most disadvantaged SEIFA quintiles, and it follows that the most healthcare cost savings overall would accrue to these groups. The expected out-of-pocket tax expenditure was highest in the most disadvantaged quintile; however, the difference of 0.32% points (less than 10¢) between the lowest and highest quintiles in proportion of household spending on food and non-alcoholic beverages per week was small. Our results indicate that, as a proportion of overall spending, the lowest SEIFA quintiles would have the largest out-of-pocket healthcare cost savings.

The DWLs for each SEIFA quintile, as well as for the whole population, were negative. This indicates that the loss of consumer/producer benefit would be outweighed by the amount of tax collected under our assumptions. The ‘loss in economic welfare’ is often calculated as the dollar amount of DWL in excess of dollar taxation revenue collected by the government. In our analysis there is a substantial net taxation gain suggestive of an improvement in economic welfare (this underlies the rationale for internalisation of negative externalities). But there are also behavioural responses associated with this inherently dynamic interaction that are difficult to model in these formulaic terms—desirably, industry would realign to healthier products and minimise its loss in producer surplus, consumers would realign to healthier purchases and minimise their loss in consumer surplus, and, finally, the tax revenue could be utilised for welfare-enhancing initiatives.

In the United Kingdom, it was considered reasonable to assume a pass-through rate of 100%; however, empirical evidence is mixed. The effect of manufacturers or retailers absorbing part of the tax could decrease the impact of the tax and the resulting health benefits; however, based on our predicted results for a 50% pass-through, the healthcare cost savings would nevertheless be substantial. There could also be an additional ‘halo effect’—a decrease in purchasing of SSBs from the introduction of the tax caused by increased public health awareness.

This research builds on the growing evidence that a tax on SSBs would deliver the largest health gains for the lowest socioeconomic groups. It also reinforces previous findings that the overall amount of tax per capita for a 20% value-added tax is around $30 per year, or less than 60¢ per week, and differences in tax expenditure between the lowest and highest socioeconomic groups are small [19].

The predicted body weight losses in our study are lower than those in Sharma et al.’s study [28], and this is because we took into account age and sex differences. Tax expenditures in our study are higher overall, and this is due to different price assumptions, as well as differing baseline intake of SSBs. The differences in baseline intake can be explained by the differing data collection methods. We used individual survey data recorded over 2 days from the AHS 2011–12, from which we took an average daily intake. These averages are close to the estimates from Euromonitor International of per capita purchases of SSBs in Australia [55]. Our predicted HALYs saved and expected tax revenue are slightly higher than in the previous Australian study that also modelled a 20% tax on SSBs [21], but this to be expected given that we included children in our analysis. Our predicted healthcare cost savings are higher due to a different method for calculating cancer treatment costs, based on the incidence rates rather than prevalence, and all costs have been updated to 2010.

This is possibly the first cost-effectiveness study to include the explicit health and economic outcomes by SEP and the resulting DWLs. It also expands on previous Australian research to include a wider range of SSBs and substitute beverages. We used conservative own-price elasticities that were close to half the value of other published price elasticities for soft drinks [45,56]. They take into account that SSB prices are not fixed, and households might face a quality—quantity tradeoff for each beverage and could opt for cheaper brands if they prefer quantity over quality [28].

When comparing our average changes in adult kilojoule intake per day for the population to a randomised control trial of overweight and obese adults who replaced all caloric SSBs with non-caloric beverages, the tax has approximately 20%–26% of the impact of the results from the trial (49 kcal/day decrease in our model versus 260 kcal/day and 187 kcal/day decreases for overweight and obese individuals, respectively, in the trial) [57]. This proportion of the effect is similar to the average change in own-price elasticities of consumption across all categories of SSBs of approximately 23% for all households as a result of a 20% SSB tax when compared to the trial [28].

As with all simulation models, the model results represent the best estimate of a potential effect in the absence of stronger direct evidence. We used an aggregate area-based indicator of SEP (SEIFA), as we were unable to obtain income-specific input data. We therefore assumed that price elasticities for household income groups were similar for SEIFA groups. There are also inherent limitations of survey data, such as misreporting, which may have affected the baseline intake of SSBs. Cross-price elasticities of food substitutes by SEP were not available, so these were not included [58]. Around 75% of soft drink sales are from supermarkets, and prices may be slightly different to our estimates.

In some instances, we used costing frameworks from the US and NZ in the absence of Australian estimates. NZ costs for policy advice provided by government agencies to parliament related to new laws is likely to be similar to their Australian equivalents, as the legal systems and number of new laws passed in Australia and NZ are similar. Costs to the government for compliance and administration of the introduction of plain packaging of tobacco products in Australia were similar to our estimates [46].

The model does not incorporate the effects of changes in SSB consumption on oral health or indirect costs, such as reduced productivity due to absenteeism and disability, which means that the societal savings from the intervention are likely to be substantially underestimated, especially to those in the most disadvantaged groups. The assumptions for the quality of life lost in children due to obesity are based on the best available evidence, but this evidence is from only particular age groups of school-aged children, and we have assumed the effects are similar for a wider age group.

Dedicating a portion of the substantial revenue generated from SSB taxes to efforts to reduce and prevent obesity among the most disadvantaged populations could be a way to further reduce concerns about the impact of the tax on low SEP groups. Hypothecation of taxes is also effective in generating public support [59]. There is evidence in Australia that earmarking the tax revenue for subsidising healthy food [60], tackling childhood obesity, and supporting children’s sport [61] and health promotion initiatives [62] would raise the public support for such a tax. Future studies could examine where to direct the revenue from an SSB tax for optimal equity, efficiency, and affordability.

Many countries and jurisdictions around the world have committed to an SSB tax, and this analysis shows that a 20% SSB tax is likely to result in a decrease in the purchase and consumption of sugary drinks, leading to significant health gains and healthcare expenditure savings across all quintiles of SEP. The tax would result in considerable yearly revenue that the government could use to reduce the regressive financial impacts, by funding programs to further improve the health of the most disadvantaged. Australia should consider a tax on SSBs as part of a suite of recommended policies to reduce the rates of obesity.

Supporting Information

Zdroje

1. Friel S, Broom D. Unequal society, unhealthy weight: the social distribution of obesity. In: Dixon J, Broom D, editors. The 7 deadly sins of obesity: how the modern world is making us fat. Sydney: University of New South Wales Press; 2007. pp. 148–72.

2. Crombie L, Irvine L, Elliott L, Wallace H. Closing the health inequalities gap: an international perspective. Copenhagen: World Health Organization Regional Office for Europe; 2005.

3. Vartanian L, Schwartz M, Brownell K. Effects of soft drink consumption on nutrition and health: a systematic review and meta-analysis. Am J Public Health. 2007;97 : 667–75. doi: 10.2105/AJPH.2005.083782 17329656

4. Malik V, Schulze M, Hu F. Intake of sugar-sweetened beverages and weight gain: a systematic review. Am J Clin Nutr. 2006;84 : 274–88. 16895873

5. Hubert HB, Feinleib M, McNamara PM, Castelli WP. Obesity as an independent risk factor for cardiovascular disease: a 26-year follow-up of participants in the Framingham Heart Study. Circulation. 1983;67 : 968–77. 6219830

6. GBD 2010 Country Collaboration. GBD 2010 country results: a global public good. Lancet. 2013;381 : 965–70. doi: 10.1016/S0140-6736(13)60283-4 23668561

7. Mokdad AH, Ford ES, Bowman BA, Dietz WH, Vinicor F, Bales VS, et al. Prevalence of obesity, diabetes, and obesity-related health risk factors, 2001. JAMA. 2003;289 : 76–9. 12503980

8. Mullie P, Aerenhouts D, Clarys P. Demographic, socioeconomic and nutritional determinants of daily versus non-daily sugar-sweetened and artificially sweetened beverage consumption. Eur J Clin Nutr. 2012;66 : 150–5. doi: 10.1038/ejcn.2011.138 21829215

9. van Ansem WJ, van Lenthe FJ, Schrijvers CT, Rodenburg G, van de Mheen D. Socio-economic inequalities in children’s snack consumption and sugar-sweetened beverage consumption: the contribution of home environmental factors. Br J Nutr. 2014;112 : 467–76. doi: 10.1017/S0007114514001007 24833428

10. Institute of Medicine. Accelerating progress in obesity prevention: solving the weight of the nation. Washington (DC): National Academies Press; 2012.

11. National Preventative Health Taskforce. Australia: the healthiest country by 2020—national preventative health strategy—overview. Canberra: Commonwealth of Australia; 2009.

12. Brownell KD, Farley T, Willett WC, Popkin BM, Chaloupka FJ, Thompson JW, et al. The public health and economic benefits of taxing sugar-sweetened beverages. New Engl J Med. 2009;361 : 1599–605. doi: 10.1056/NEJMhpr0905723 19759377

13. Andreyeva T, Long MW, Brownell KD. The impact of food prices on consumption: a systematic review of research on the price elasticity of demand for food. Am J Public Health. 2010;100 : 216–22. doi: 10.2105/AJPH.2008.151415 20019319

14. Cabrera Escobar MA, Veerman JL, Tollman SM, Bertram MY, Hofman KJ. Evidence that a tax on sugar sweetened beverages reduces the obesity rate: a meta-analysis. BMC Public Health. 2013;13 : 1–10.

15. Duckett S, Swerissen H. A sugary drinks tax: recovering the community costs of obesity. Melbourne: Grattan Institute; 2016.

16. Jensen JD, Smed S. Cost-effective design of economic instruments in nutrition policy. Int J Behav Nutr Phys Act. 2007;4 : 10. doi: 10.1186/1479-5868-4-10 17408494

17. Colchero MA, Popkin BM, Rivera JA, Ng SW. Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study. BMJ. 2016;352:h6704. doi: 10.1136/bmj.h6704 26738745

18. Colchero MA, Rivera-Dommarco J, Popkin BM, Ng SW. In Mexico, evidence of sustained consumer response two years after implementing a sugar-sweetened beverage tax. Health Aff (Millwood). 2017;36 : 564–71.

19. Backholer K, Sarink D, Beauchamp A, Keating C, Loh V, Ball K, et al. The impact of a tax on sugar-sweetened beverages according to socio-economic position: a systematic review of the evidence. Public Health Nutr. 2016 : 1–15.

20. Cobiac LJ, Tam K, Veerman L, Blakely T. Taxes and subsidies for improving diet and population health in Australia: a cost-effectiveness modelling study. PLoS Med. 2017;14:e1002232. doi: 10.1371/journal.pmed.1002232 28196089

21. Veerman JL, Sacks G, Antonopoulos N, Martin J. The impact of a tax on sugar-sweetened beverages on health and health care costs: a modelling study. PLoS ONE. 2016;11:e0151460. doi: 10.1371/journal.pone.0151460 27073855

22. World Health Organization. Fiscal policies for diet and prevention of noncommunicable diseases: technical meeting report. Geneva: World Health Organization; 2016.

23. Backholer K, Blake M, Vandevijvere S. Have we reached a tipping point for sugar-sweetened beverage taxes? Public Health Nutr. 2016;19 : 3057–61. doi: 10.1017/S1368980016003086 27910794

24. Australian Bureau of Statistics. Australian Health Survey 2011–12. Canberra: Australian Bureau of Statistics; 2015.

25. Murray CJ, Atkinson C, Bhalla K, Birbeck G, Burstein R, Chou D, et al. The state of US health, 1990–2010: burden of diseases, injuries, and risk factors. JAMA. 2013;310 : 591–608. doi: 10.1001/jama.2013.13805 23842577

26. StataCorp. Stata Statistical Software. Release 14. College Station (Texas): StataCorp; 2015.

27. Australian Bureau of Statistics. Deciles. http://www.abs.gov.au/websitedbs/censushome.nsf/home/seifatbdeciles?opendocument&navpos=260. Accessed 8 Nov 2016.

28. Sharma A, Hauck K, Hollingsworth B, Siciliani L. The effects of taxing sugar-sweetened beverages across different income groups. Health Econ. 2014;23 : 1159–84. doi: 10.1002/hec.3070 24895084

29. Food Standards Australia and New Zealand. NUTTAB 2010 online searchable database. http://www.foodstandards.gov.au/science/monitoringnutrients/nutrientables/nuttab/Pages/default.aspx. Accessed 15 Nov 2016.

30. Hall KD, Sacks G, Chandramohan D, Chow CC, Wang YC, Gortmaker SL, et al. Quantification of the effect of energy imbalance on bodyweight. Lancet. 2011;378 : 826–37. doi: 10.1016/S0140-6736(11)60812-X 21872751

31. Hall KD, Butte NF, Swinburn BA, Chow CC. Dynamics of childhood growth and obesity: development and validation of a quantitative mathematical model. Lancet Diabetes Endocrinol. 2013;1 : 97–105. 24349967

32. Carter R, Moodie M, Markwick A, Magnus A, Vos T, Swinburn B, et al. Assessing cost-effectiveness in obesity (ACE-obesity): an overview of the ACE approach, economic methods and cost results. BMC Public Health. 2009;9 : 419. doi: 10.1186/1471-2458-9-419 19922625

33. Vos T, Carter R, Doran C, Anderson I, Lopez A, Wilson A. Assessing cost-effectiveness in the prevention of non-communicable disease (ACE-Prevention) project 2005–09: economic evaluation protocol (as per September 2007). Brisbane: University of Queensland; 2007.

34. Lee YY, Veerman JL, Barendregt JJ. The cost-effectiveness of laparoscopic adjustable gastric banding in the morbidly obese adult population of Australia. PLoS ONE. 2013;8:e64965. doi: 10.1371/journal.pone.0064965 23717680

35. Cobiac L, Vos T, Veerman L. Cost-effectiveness of Weight Watchers and the Lighten Up to a Healthy Lifestyle program. Aust N Z J Public Health. 2010;34 : 240–7. doi: 10.1111/j.1753-6405.2010.00520.x 20618263

36. Veerman JL, Barendregt JJ, Forster M, Vos T. Cost-effectiveness of pharmacotherapy to reduce obesity. PLoS ONE. 2011;6:e26051. doi: 10.1371/journal.pone.0026051 22046255

37. Begg S, Vos T, Barker B, Stevenson C, Stanley L, Lopez A. The burden of disease and injury in Australia 2003. Canberra: Australian Institute of Health and Welfare; 2007.

38. Australian Institute of Health and Welfare. Cardiovascular disease by populations of interest. Canberra: Australian Institute of Health and Welfare; 2012.

39. Australian Institute of Health and Welfare. Cancer in Australia: an overview 2014. Canberra: Australian Institute of Health and Welfare; 2014.

40. Australian Institute of Health and Welfare. Incidence of insulin-treated diabetes in Australia 2000–2011. Canberra: Australian Institute of Health and Welfare; 2014.

41. Australian Institute of Health and Welfare. Supplementary data for mortality inequalities in Australia 2009–2011. Canberra: Australian Institute of Health and Welfare; 2014.

42. Australian Bureau of Statistics. Australian Health Survey: updated results, 2011–12. Canberra: Australian Bureau of Statistics; 2013.

43. Australian Bureau of Statistics. 2011 census of population and housing. Canberra: Australian Bureau of Statistics; 2012.

44. Chen G, Ratcliffe J, Olds T, Magarey A, Jones M, Leslie E. BMI, health behaviors, and quality of life in children and adolescents: a school-based study. Pediatrics. 2014;133:e868–74. doi: 10.1542/peds.2013-0622 24590749

45. Long MW, Gortmaker SL, Ward ZJ, Resch SC, Moodie ML, Sacks G, et al. Cost effectiveness of a sugar-sweetened beverage excise tax in the U.S.. Am J Prev Med. 2015;49 : 112–23. doi: 10.1016/j.amepre.2015.03.004 26094232

46. Department of Health. Post-implementation review tobacco plain packaging. Canberra: Department of Health; 2016.

47. Wilson N, Nghiem N, Foster R, Cobiac L, Blakely T. Estimating the cost of new public health legislation. Bull World Health Organ. 2012;90 : 477–556.

48. Australian Institute of Health and Welfare. Disease Costs and Impact Study. Canberra: Australian Institute of Health and Welfare; 2001.

49. Australian Institute of Health and Welfare. Health expenditure Australia 2010–11. Canberra: Australian Institute of Health and Welfare; 2012.

50. Yusuf F, Leeder SR. Can’t escape it: the out-of-pocket cost of health care in Australia. Med J Aust. 2013;199 : 475–8. 24099208

51. Gold M, Siegel J, Russell L, Weinstein MC. Cost-effectiveness in health and medicine. New York: Oxford University Press; 1996.

52. Ersatz. Version 1.3. Noosa: EpiGear; 2016.

53. Australian Bureau of Statistics. 6348.0—labour costs, Australia, 2010–11. Canberra: Australian Bureau of Statistics; 2012.

54. Kakwani N, Wagstaff A, van Doorslaer E. Socioeconomic inequalities in health: Measurement, computation, and statistical inference. J Econom. 1997;77 : 87–103.

55. Euromonitor International. Soft drinks in Australia. Sydney: Euromonitor International; 2016.

56. Ni Mhurchu C, Eyles H, Schilling C, Yang Q, Kaye-Blake W, Genç M, et al. Food prices and consumer demand: differences across income levels and ethnic groups. PLoS ONE. 2013;8:e75934. doi: 10.1371/journal.pone.0075934 24098408

57. Tate DF, Turner-McGrievy G, Lyons E, Stevens J, Erickson K, Polzien K, et al. Replacing caloric beverages with water or diet beverages for weight loss in adults: main results of the Choose Healthy Options Consciously Everyday (CHOICE) randomized clinical trial. Am J Clin Nutr. 2012;95 : 555–63. doi: 10.3945/ajcn.111.026278 22301929

58. Colchero MA, Salgado JC, Unar-Munguia M, Hernandez-Avila M, Rivera-Dommarco JA. Price elasticity of the demand for sugar sweetened beverages and soft drinks in Mexico. Econ Hum Biol. 2015;19 : 129–37. doi: 10.1016/j.ehb.2015.08.007 26386463

59. Doetinchem O. Hypothecation of tax revenue for health. Geneva: World Health Organization; 2010.

60. Morley B, Martin J, Niven P, Wakefield M. Public opinion on food-related obesity prevention policy initiatives. Health Promot J Austr. 2012;23 : 86–91. 23088483

61. Martin J, Morley B, Niven B. Sugar-sweetened beverage (SSB) tax: framing the message for public acceptability. Behavioural Research in Cancer Control Conference 2015; 12–15 May 2015; Sydney, Australia.

62. VicHealth. Victoria’s citizens’ jury on obesity. Melbourne: VicHealth; 2015.

Štítky

Interní lékařství

Článek vyšel v časopisePLOS Medicine

Nejčtenější tento týden

2017 Číslo 6- Není statin jako statin aneb praktický přehled rozdílů jednotlivých molekul

- Magnosolv a jeho využití v neurologii

- Biomarker NT-proBNP má v praxi široké využití. Usnadněte si jeho vyšetření POCT analyzátorem Afias 1

- Moje zkušenosti s Magnosolvem podávaným pacientům jako profylaxe migrény a u pacientů s diagnostikovanou spazmofilní tetanií i při normomagnezémii - MUDr. Dana Pecharová, neurolog

- Antikoagulační léčba u pacientů před operačními výkony

-

Všechny články tohoto čísla

- Vaccination to prevent human papillomavirus infections: From promise to practice

- Reducing US cardiovascular disease burden and disparities through national and targeted dietary policies: A modelling study

- Contribution of cognitive performance and cognitive decline to associations between socioeconomic factors and dementia: A cohort study

- Modelled health benefits of a sugar-sweetened beverage tax across different socioeconomic groups in Australia: A cost-effectiveness and equity analysis

- Risk factors and short-term projections for serotype-1 poliomyelitis incidence in Pakistan: A spatiotemporal analysis

- The US President’s Malaria Initiative and under-5 child mortality in sub-Saharan Africa: A difference-in-differences analysis

- Estimating the causal influence of body mass index on risk of Parkinson disease: A Mendelian randomisation study

- Low-intensity cognitive-behaviour therapy interventions for obsessive-compulsive disorder compared to waiting list for therapist-led cognitive-behaviour therapy: 3-arm randomised controlled trial of clinical effectiveness

- Population-level impact of an accelerated HIV response plan to reach the UNAIDS 90-90-90 target in Côte d’Ivoire: Insights from mathematical modeling

- Validity of a minimally invasive autopsy for cause of death determination in stillborn babies and neonates in Mozambique: An observational study

- Malaria control adds to the evidence for health aid effectiveness

- Effectiveness and equity of sugar-sweetened beverage taxation

- A Collection on the prevention, diagnosis, and treatment of sexually transmitted infections: Call for research papers

- Pathways and progress to enhanced global sexually transmitted infection surveillance

- Elimination of mother-to-child transmission of HIV and Syphilis (EMTCT): Process, progress, and program integration

- Assessing process, content, and politics in developing the global health sector strategy on sexually transmitted infections 2016–2021: Implementation opportunities for policymakers

- Validity of a minimally invasive autopsy tool for cause of death determination in pediatric deaths in Mozambique: An observational study

- Mammographic density and ageing: A collaborative pooled analysis of cross-sectional data from 22 countries worldwide

- PLOS Medicine

- Archiv čísel

- Aktuální číslo

- Informace o časopisu

Nejčtenější v tomto čísle- Mammographic density and ageing: A collaborative pooled analysis of cross-sectional data from 22 countries worldwide

- Vaccination to prevent human papillomavirus infections: From promise to practice

- A Collection on the prevention, diagnosis, and treatment of sexually transmitted infections: Call for research papers

- Elimination of mother-to-child transmission of HIV and Syphilis (EMTCT): Process, progress, and program integration

Kurzy

Zvyšte si kvalifikaci online z pohodlí domova

Autoři: prof. MUDr. Vladimír Palička, CSc., Dr.h.c., doc. MUDr. Václav Vyskočil, Ph.D., MUDr. Petr Kasalický, CSc., MUDr. Jan Rosa, Ing. Pavel Havlík, Ing. Jan Adam, Hana Hejnová, DiS., Jana Křenková

Autoři: MUDr. Irena Krčmová, CSc.

Autoři: MDDr. Eleonóra Ivančová, PhD., MHA

Autoři: prof. MUDr. Eva Kubala Havrdová, DrSc.

Všechny kurzyPřihlášení#ADS_BOTTOM_SCRIPTS#Zapomenuté hesloZadejte e-mailovou adresu, se kterou jste vytvářel(a) účet, budou Vám na ni zaslány informace k nastavení nového hesla.

- Vzdělávání